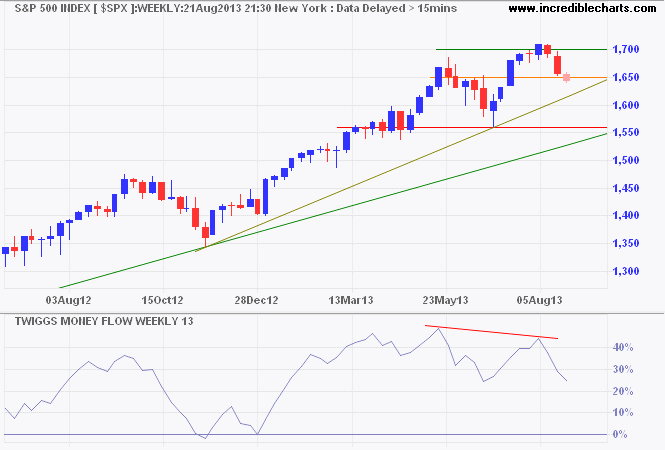

Sydney, Aug.22, investment opportunities .- The S&P 500 Index broke medium-term support at 1650 and is headed for a test of the rising trendline. Respect would indicate the primary up-trend is intact, but bearish divergence on 13-week Twiggs Money Flow warns of selling pressure. This is also evidenced by the marginal new high in August. A test of primary support at 1560 is likely. Breach would offer a target of 1400*.

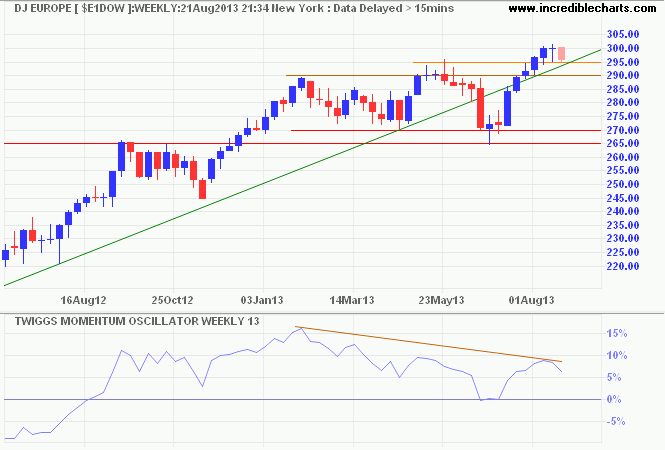

Dow Jones Europe Index also displays marginal new highs in May and August. Penetration of the rising trendline indicates the up-trend is losing momentum — also indicated by bearish divergence on 13-week Twiggs Momentum. Reversal below support at 290 would strengthen the warning, but only failure of support at 270 would signal a trend reversal.

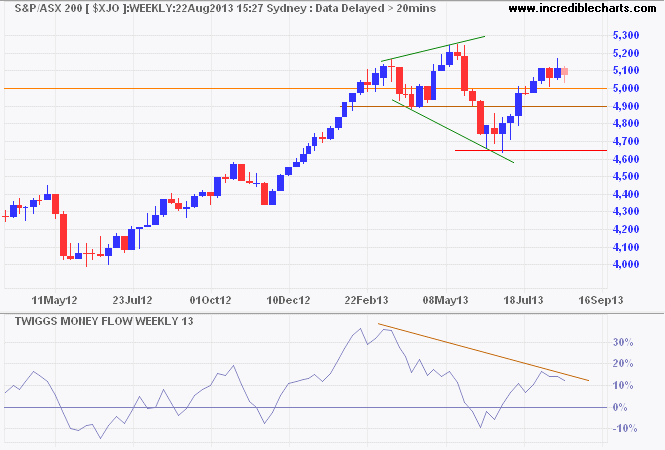

The ASX 200 is consolidating in a broadening top around the 2010/2011 high of 5000. Correction to 4900 would be quite acceptable, garnering support for an advance to the upper border, but breach of 4900 would indicate a failed swing, warning of reversal to a primary down-trend. Failure of primary support at 4650 would confirm. Bearish divergence on 13-week Twiggs Money Flow indicates selling pressure; strengthened if the indicator reverses below zero. Respect of support at 5000 is less likely, despite the long tail on today's candle, but would offer a target of 5300*.

No comments:

Post a Comment